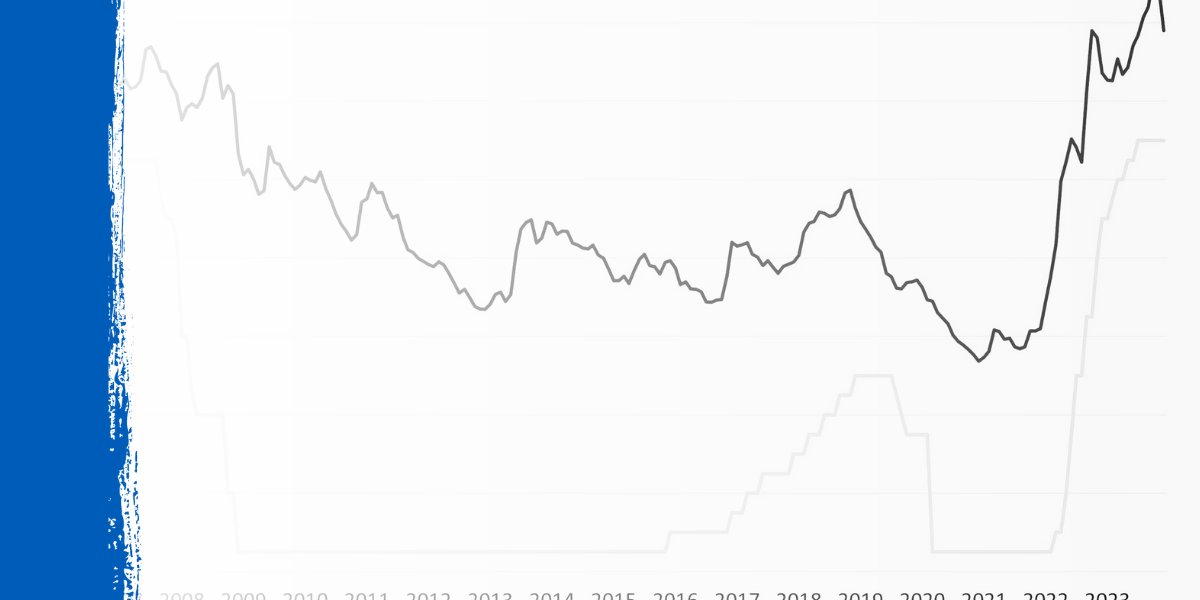

In September 2024, the Federal Reserve made a significant move that has caught the attention of professional builders and remodelers across the nation. The Federal Open Market Committee (FOMC) announced a major reduction in the short-term federal funds rate, marking the beginning of an easing cycle after years of tight monetary policy. This shift aims to balance inflation control with fostering economic growth, particularly in the labor market.

In this blog post, we'll explore what this change means for the housing market and how it can impact your work as builders and remodelers.

What is the Federal Interest Rate?

The federal interest rate, often referred to as the federal funds rate, is the interest rate at which depository institutions trade federal funds with each other overnight. This rate influences various economic activities, including borrowing costs for homes, cars, and business investments.

Why Did the Fed Change the Rate?

The recent rate cut of 50 basis points from 5.5% to 5% was implemented to combat the lingering effects of high inflation while addressing concerns about the labor market's health. The FOMC's statement highlighted that while job gains have slowed and the unemployment rate has slightly increased, inflation has shown progress toward the committee's 2% target, necessitating a recalibration of monetary policy.

The Impact on the Housing Market

Lower Borrowing Costs

One of the immediate effects of the rate cut is lower borrowing costs. Mortgage rates, which have already decreased from 6.7% to 6.2% in recent weeks, are expected to continue their downward trend. This reduction makes home loans more affordable for buyers, potentially increasing demand for new homes and remodels.

Builder and Developer Loans

For professional builders and remodelers, the cost of loans for building and development projects is a critical factor. The reduction in the federal funds rate should lead to lower interest rates for these loans by approximately 25 to 50 basis points, making it cheaper to finance new projects. This is a bullish sign for housing affordability and can stimulate more construction activity.

Increased Housing Supply

Higher short-term interest rates in the past have limited the availability of builder and developer loans, contributing to elevated shelter costs and inflation. With the Fed's recent easing, builders can expect more favorable financing conditions, enabling them to increase housing supply. This is crucial for addressing long-term shelter inflation and meeting market demand.

What Builders and Remodelers Should Watch For

Future Rate Cuts

The Fed's statement indicates that this rate cut is just the beginning of a series of reductions expected to bring the top target rate down to around 3% in the coming quarters. However, the pace of these cuts will depend on economic conditions. Builders and remodelers should stay informed about future FOMC meetings and policy announcements to anticipate changes in loan costs and market conditions.

Economic Projections

The Fed's updated economic projections forecast a slowing economy but no recession, with GDP growth rates of 2% for 2025 and 2026. While the unemployment rate is expected to rise to 4.4%, it remains relatively low. These projections suggest a stable environment for housing, with ongoing demand for new construction and remodeling projects.

Regulatory Impacts

While lower federal interest rates are beneficial, other factors such as zoning regulations and local policies also influence the housing market. Builders and remodelers should advocate for efficient zoning and regulatory reforms to complement the benefits of lower borrowing costs.

Conclusion

The recent federal interest rate change presents a mix of opportunities and challenges for professional builders and remodelers. Lower borrowing costs and improved financing conditions can stimulate more construction activity and help address housing supply issues. However, staying informed about future rate changes and advocating for supportive regulations will be crucial for maximizing these benefits.

At LS Building Products, we are committed to helping you navigate these changes and succeed in your projects. Stay tuned for more industry updates in our contractor blog, "Building Success". If you have any questions or need personalized advice, feel free to reach out to our team.

Ready to take advantage of the new market conditions? Contact us today to discuss how we can help you with your next project. Let's build success together!

.png?width=98&height=67&name=Logo%20(13).png)

Federal Interest Rate Change and the Housing Market" loading="lazy">

Federal Interest Rate Change and the Housing Market" loading="lazy">

.jpg)