The construction industry is bracing for significant changes as new lumber tariffs reshape the market landscape. Recent policy shifts and international trade tensions have created a complex environment that will impact material costs, availability, and project timelines across the United States. For contractors, builders, and homeowners alike, understanding these developments is crucial for effective planning and budgeting in the coming months.

At LS Building Products, we're committed to keeping our customers informed about market conditions affecting our extensive selection of lumber and engineered wood products. This comprehensive analysis examines the current state of lumber tariffs, their immediate impacts, and what to expect throughout 2025 and beyond.

Key Takeaways

- Tariffs on Canadian lumber are set to more than double from 14.5% to 34.5% by September 2025, according to the US Department of Commerce's preliminary determination.

- Housing costs are projected to increase by approximately $9,200 per home due to tariff-related price increases, based on NAHB/Wells Fargo Housing Market Index data.

- Domestic production initiatives, including a presidential executive order for a 25% increase in timber harvesting from federal lands, aim to offset import reductions but will take time to impact the market.

- Supply chain disruptions are expected as the market adjusts, with potential spot shortages in regions heavily dependent on Canadian imports.

- Alternative sourcing from European suppliers is increasing but faces challenges including higher shipping costs and potential retaliatory tariffs.

- Construction sector contraction of approximately 3.1% is projected by economic analysts, while manufacturing output for wood products may expand by 1.5%.

Current State of US Lumber Tariffs

The lumber market is currently experiencing significant policy shifts that will reshape supply chains and pricing structures throughout 2025 and beyond. The most impactful development is the US Department of Commerce's preliminary determination to more than double existing duties on Canadian softwood lumber.

Current countervailing and anti-dumping duties on Canadian lumber stand at 14.5%, but the Commerce Department's annual review has proposed increasing this levy to 34.5%. The official determination is expected to be published in the Federal Register imminently, with a final review coming in August or September 2025.

These specific lumber duties are separate from the broader global reciprocal tariffs announced by President Trump earlier this year. In a significant win for the construction industry, the administration has continued current exemptions for Canadian and Mexican products, including a specific exemption for lumber from any new global tariffs at this time.

Adding another layer of complexity, the White House issued an executive order in March commanding the Commerce Department to investigate the national security impacts of imports of timber and lumber under Section 232. This investigation could potentially lead to additional tariffs beyond the already announced increases.

Impact on Lumber Prices and Availability

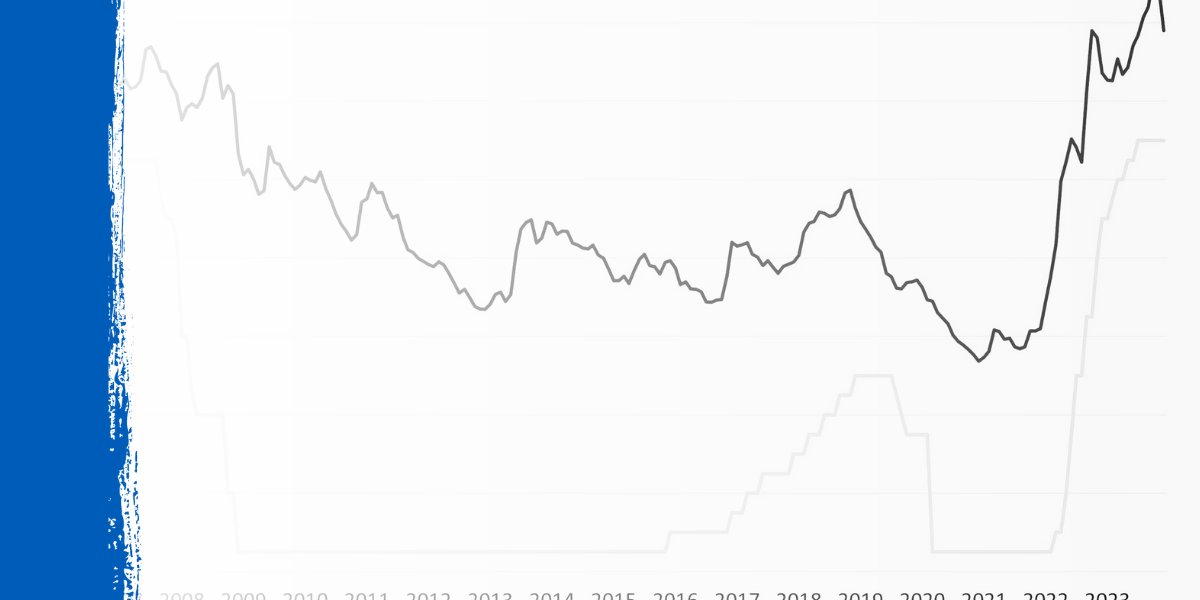

The tariff increases are already affecting market dynamics, with more significant impacts expected as higher rates take effect later this year.

According to Yale University's Budget Lab, the overall price level from all 2025 tariffs is projected to rise by 1.7% in the short run, translating to an average per household consumer loss of $2,800. For the construction industry specifically, lumber price increases are expected to be more pronounced.

The NAHB estimates that tariffs on lumber and other critical homebuilding materials could raise the average cost of a home by $9,200, based on their March 2025 Housing Market Index. This substantial increase threatens housing affordability at a time when many markets are already experiencing accessibility challenges.

The US currently produces approximately 35 billion board feet of lumber annually but consumes around 50 billion board feet. This 15-billion-board-foot gap is primarily filled by imports, with Canada accounting for approximately 30% of US consumption.

As tariffs increase, supply chain disruptions are likely, particularly in regions heavily dependent on Canadian imports. While European suppliers have been stepping in to fill gaps during previous Canadian supply disruptions, this alternative sourcing comes with higher shipping costs and longer lead times.

In response to these challenges, President Trump signed an executive order calling for a 25% increase in timber production from federal lands. While this initiative aims to move the US toward greater self-sufficiency, industry experts note that it will likely take months, if not years, before the market feels any significant impact from these actions.

Future Market Outlook and Expectations

Understanding the trajectory of lumber markets over different time horizons is essential for effective planning and risk management.

Short-Term Outlook (Next 6 Months)

In the immediate future, expect significant price volatility as markets absorb the news of impending tariff increases. When Canadian tariffs rise to 34.5% in September, price increases of 15-25% are possible for certain lumber products. Builders and suppliers may experience spot shortages in specific regions as supply chains adjust to the new reality.

Many contractors are likely to accelerate purchases ahead of the September tariff implementation, potentially creating temporary demand spikes and inventory challenges. Our custom millwork can help you plan projects efficiently during this volatile period.

Medium-Term Outlook (6-12 Months)

As we move into early 2026, prices will likely plateau at higher levels as the market adjusts to the new tariff structure. US domestic production will gradually increase but remain below total demand. European suppliers will establish more consistent supply chains to the US market, helping to stabilize availability.

The construction sector will begin adapting practices to accommodate higher material costs, including more efficient use of lumber and greater consideration of alternative materials. Policy developments, including potential trade negotiations and the results of the Section 232 investigation, could introduce new variables during this period.

Long-Term Outlook (1-2 Years)

By mid-2026 and beyond, we expect to see structural changes in the lumber market. US domestic production capacity will expand but likely remain below total demand. Import sources will become more diversified beyond traditional Canadian suppliers, and the industry will increase adoption of alternative building materials and methods.

Economic impacts will become more pronounced, with Yale Budget Lab projecting housing starts potentially reduced by 5-10% due to higher costs. The manufacturing output for wood products may expand by 1.5%, but the overall construction sector could contract by 3.1%, contributing to a potentially 0.4% smaller US economy (approximately $110 billion annually).

Strategies for Navigating the Changing Market

As the lumber market evolves in response to these tariff changes, several strategies can help mitigate impacts on your projects and operations.

With tariff increases scheduled for September, consider advancing purchases of lumber and wood products for projects planned through early 2026. Working with reliable suppliers who can secure inventory ahead of tariff implementation can provide significant cost savings.

Explore alternative materials and building methods that may reduce dependency on products facing the steepest tariff increases. Engineered wood products, which often use raw materials more efficiently, may offer cost advantages in certain applications. LS Building Products offers a comprehensive selection to meet diverse project needs.

As US production capacity increases in response to market conditions, explore domestic sourcing options that may be less affected by import tariffs. While domestic supply cannot immediately replace all imports, establishing relationships with US producers can provide greater stability as the market adjusts.

For contractors and builders, consider implementing escalation clauses in contracts to account for potential material price increases. Transparent communication with clients about market conditions and potential cost impacts can help manage expectations and reduce disputes.

Looking Forward

The lumber market is entering a period of significant transition as tariff policies reshape supply chains and cost structures. While challenges lie ahead, the industry has demonstrated resilience through previous cycles of market disruption. By staying informed, planning strategically, and working with knowledgeable suppliers, businesses can navigate these changes effectively.

At LS Building Products, we remain committed to providing reliable supply, competitive pricing, and expert guidance as the market evolves. Our team continuously monitors industry developments to ensure we can support your projects with the right products at the right time.

Frequently Asked Questions (FAQ)

When will the increased Canadian lumber tariffs take effect?

The Commerce Department's preliminary determination to increase duties from 14.5% to 34.5% is expected to be finalized in August or September 2025, with implementation immediately following.

How much will these tariffs increase construction costs?

According to NAHB estimates, tariffs on lumber and other building materials could increase the average cost of a new home by approximately $9,200.

Will there be lumber shortages due to these tariffs?

While widespread shortages are not currently anticipated, spot shortages in certain regions and for specific products are possible as supply chains adjust. The market is expected to experience tighter supply conditions through at least early 2026.

Can US producers meet domestic demand without Canadian imports?

Currently, no. The US produces approximately 35 billion board feet annually but consumes around 50 billion board feet. While domestic production is expected to increase, it will take time to significantly narrow this gap.

.png?width=98&height=67&name=Logo%20(13).png)

-3.jpg) 2025 Lumber Outlook and the Impact of Tariffs" loading="lazy">

2025 Lumber Outlook and the Impact of Tariffs" loading="lazy">

.jpg)