As a professional builder or contractor, keeping your finger on the pulse of the economy is a critical aspect of your business. Interest rates are a significant factor that can shape your decision-making process as changes can have a significant impact on your bottom line. In this blog post, we will discuss the projected interest rates for 2024 and how it can impact the home building industry.

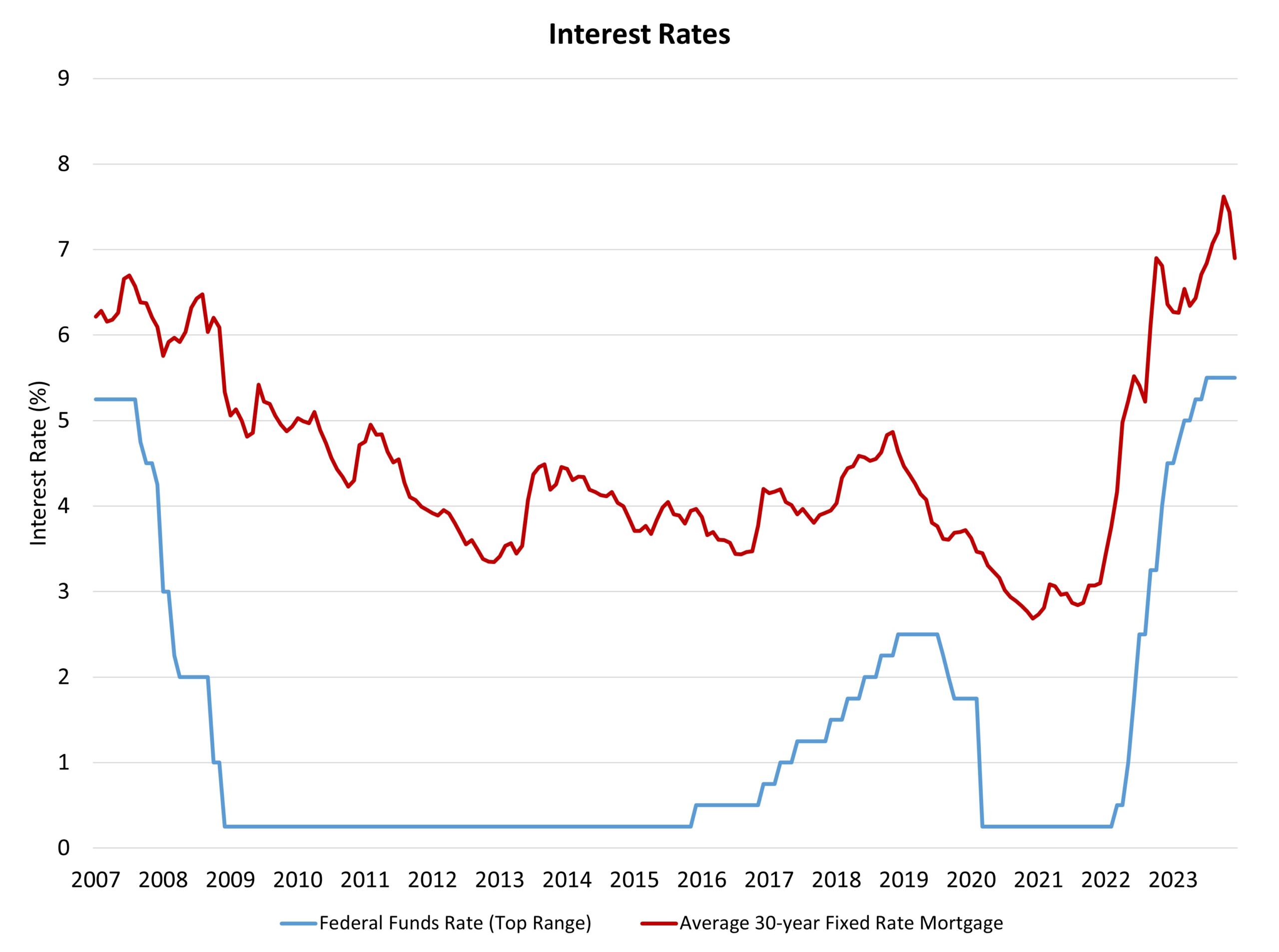

The United States economy is projected to see a shift in the interest rate landscape in the upcoming year. According to recent data from the Federal Reserve, the top target federal funds rate will remain constant at 5.5% at the end of 2023. However, this projection is expected to change in 2024, with the federal funds rate estimated to see three rate cuts next year and settling at a lower top rate of 4.75% by the end of 2024.

These projected interest rate cuts are good news for the home building industry. It means homebuyers will have easier access to affordable financing options in 2024. Lower interest rates can help stimulate buyer demand, which can lead to higher sales for builders and contractors. Moreover, low interest rates can also help existing homeowners to refinance their mortgages to pay off their home loans quickly, allowing them to build new homes in the future.

The projected rates for 2024 also indicate an optimistic economic outlook, with the Fed projecting a strong labor market and unemployment rate not rising higher than 4%. These projections align with recent mortgage rate trends, with mortgage rates expected to range slightly above 5% in 2025. The stable economic situation can offer builders and contractors a reliable market to grow their businesses positively.

However, it is essential to remember that even with significant projections, the market is unpredictable, and changes can occur suddenly. The rates can change due to various factors beyond our control, such as international events, changes in government policies, and natural disasters. Therefore, making informed decisions about your finances and investments requires attention and careful analysis of the market trends.

Source - https://eyeonhousing.org/2023/12/the-fed-projects-lower-rates-in-2024/

Staying up-to-date with the economic projections is essential for builders and contractors in the home building industry. Interest rates fluctuations can impact your business opportunities, bottom line, and the entire industry's growth. The projected interest rate cuts in 2024 show a positive outlook for the home building industry, with a projected strong labor market and lower unemployment rate. These interest rates' projected stability can help industry players plan their investments and business strategies with more confidence. As the market is constantly changing, builders and contractors must always keep an eye on trends and ensure they're making informed decisions concerning their businesses.

.png?width=98&height=67&name=Logo%20(13).png)

2024 Interest Rates & Home Building" loading="lazy">

2024 Interest Rates & Home Building" loading="lazy">